maine tax rates for retirees

Up to date 2022 Louisiana sales tax rates. However the marketplace has a program called premium tax credits that provides discounted rates for those who have low to moderate incomes.

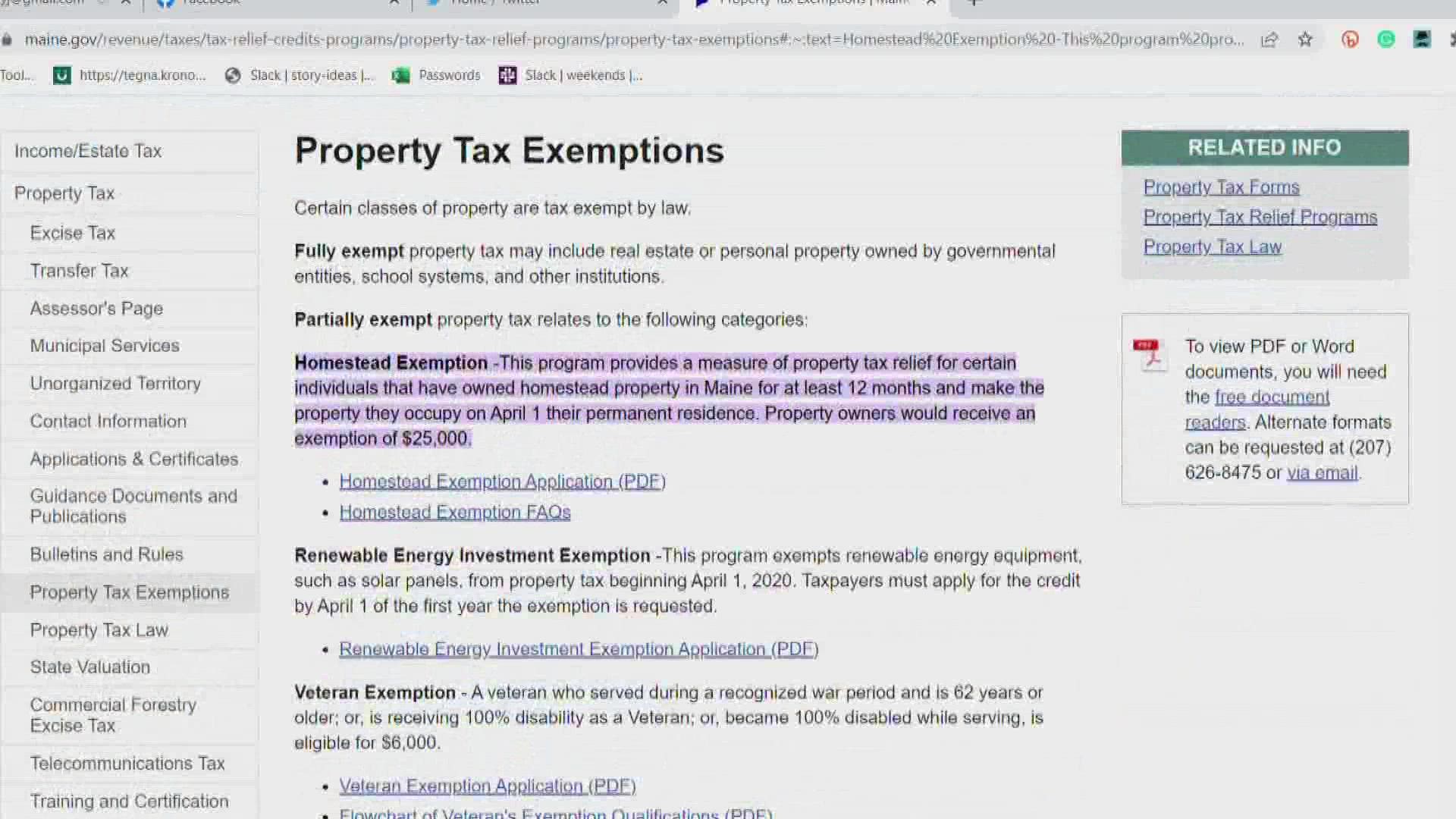

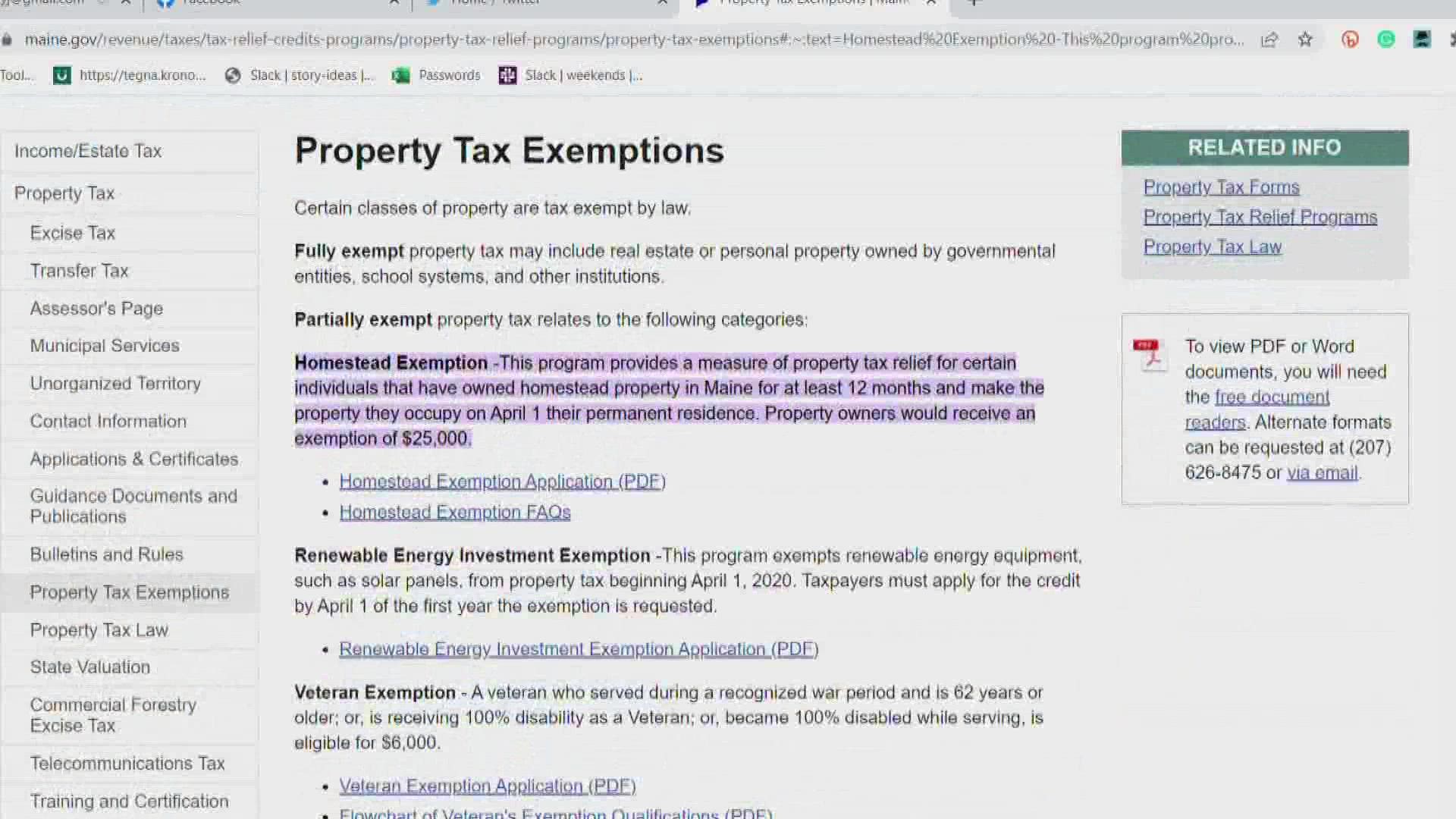

Older Mainers Are Now Eligible For Property Tax Relief Newscentermaine Com

Retirees get tax breaks but must contend with high property taxes.

. Tax increment financing TIF is a public financing method that is used as a subsidy for redevelopment infrastructure and other community-improvement projects in many countries including the United StatesThe original intent of a TIF program is to stimulate private investment in a blighted area that has been designated to be in need of economic revitalization. 22450 and 53150. United Van Lines 2020 National Movers Study.

The state does not tax Social Security income and it also provides a 10000 deduction for retirement income. Another way for retirees to lower their tax burden is to relocate to a state that doesnt tax Social Security. There are only seven states nationwide that dint collect a state income tax - however when a state has no income tax it generally makes up for lost tax.

Considering Participation in IMRF. The state taxes income from retirement accounts and from pensions such as from MainePERS. Once the annuitization or.

As our Maine retirement friendliness page will show you Maine is not the most tax-friendly state for retirees. Many retirees need more than Social Security and investment savings to provide for their daily needs. There may be a silver lining though.

Quadruple Weight 635 Points Tax-Friendliness. Double Weight 317 Points Note. Maine Relative tax burden.

Up to 24000 of military retirement pay is exempt for retirees age 65 and older. State Tax on Military Pension. Virginia - In 2022 up to 10000 in retirement pay is tax-free for retirees 55 and older.

Best CD Rates in Florida FL - September 8 2022. Retirees moreover are freer to consider factors like taxation than those who are tied to a job. Seniors who receive retirement income from a 401k IRA or pension will pay tax rates as high as 715 though a small deduction is available.

Maine 58 to 715. Veterans Mortgage Program advances loans to eligible veterans at low interest rates. Box 9107 Augusta ME 04332-9107 208 626-8475.

You pay a premium to the insurance company. Use our sales tax calculator or download a free Louisiana sales tax rate table by zip code. Use this information as a guide to state and federal tax requirements for IMRF retirees.

State tax rates and rules for income sales property fuel cigarette and other taxes that impact New Jersey residents. It is easier to see why Maine is a dream retirement destination for many people including military retirees. Social Security doesnt get taxed in the state but other forms of retirement income can get taxed at rates as high as 715 says SmartAsset.

Up to date 2022 Louisiana sales tax rates. Military retirement pay is partially taxed in. Compare the highest CD rates by APY minimum balance and more.

Maine is by no means cheap to live in but if you can afford the housing and taxes youll benefit from a relatively high quality of life and lack of crime. 20000 for those ages 55 to 64. Social Security is exempt from taxation in Maine but other forms of retirement income are not.

In fact Maine is one of the few states with most veterans per capita. The state of Florida imposes a corporation tax on all corporations conducting business or earning income within the state at the following tax rates. Compare the best One-year CD rates in Alabama AL from hundreds of FDIC insured banks.

Hawaii is an example of a state friendlier toward lower-income retirees than. South Carolina Military retirees with a minimum of 20 years of active duty may exempt up to 3000 until age 65 after which an exemption of 10000 applies. Property tax exemption for veterans who are disabled or those with VA.

See veterans benefits for all 50 states. According to the Tax Foundation. And 7500 for military retirees under age 55 increasing to 10000 in 2021 and 15000 in 2022 and 2023.

Maine Revenue Services PO. No Social Security tax. Full Weight 159 Points Dollars in Defense Department Contracts per Capita.

Is Maine tax-friendly for retirees. September 8 2022 Taxes on Unemployment Benefits. Explore our weekly state tax maps to see how your state ranks on tax rates collections and more.

Both Texas tax brackets and the associated tax rates have not been changed since at least 2001. Share of Veteran-Owned Businesses. That initial investment will grow tax-deferred throughout the accumulation phase typically anywhere from ten to 30 years based on the terms of your contract.

Which States Are the Most Tax-Friendly for Retirees. Texas has no state-level income taxes although the Federal income tax still applies to income earned by Texas residents. So when youre comparing sales tax rates from state to state look at both the combined state and local sales tax.

Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax-friendly states for retirees. Tax codes vary from state to state and tax laws are subject to. Though sales taxes can be steep due to local parish and jurisdiction sales taxes.

Or have no income tax at all. This metric is based on WalletHubs Tax Rates by State report. Up to 2000 of retirement income.

Compare the highest CD rates by APY minimum balance and more. The five states with the lowest overall. Louisiana was listed on Kiplingers 2011 10 tax-friendly states for retirees.

That amount increases by 10000 each year until 2025 when up to 40000 is deductible. Up to 3500 is exempt Colorado. Best CD Rates in Alabama AL - September 8 2022.

See our Tax Map for. Compare the best One-year CD rates in Florida FL from hundreds of FDIC insured banks. They can diverge quite a bit based on factors such as income tax rates and whether Social Security payments are taxed.

Full Weight 159 Points. California tops the list with the highest income tax rates in the countryits highest tax rate is 123 but it also implements an additional tax on those with income of 1 million or more which makes its highest actual tax rate 133. Use this information as a guide to state and federal tax requirements for IMRF retirees.

For example an individual earning 51520 per year 400 of the federal poverty level would pay about 365 per month for a Silver health insurance plan.

Maine Retirement Tax Friendliness Smartasset

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Maine Estate Tax Everything You Need To Know Smartasset

Military Retirees Retirement Retired Military Military Retirement

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

Maine Property Tax Rates By Town The Master List

Maine Retirement Tax Friendliness Smartasset

New Maine Law Allowing Seniors To Freeze Property Taxes Takes Effect Maine Public

Ask Hannah Holmes Your Home Maintenance Questions Answered Home Maintenance Old Farm Houses Help Wanted

Maine Retirement Tax Friendliness Smartasset

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

Pin On Disability Social Security Retirement

Maine Sales Tax Guide And Calculator 2022 Taxjar

New Maine Law Allowing Seniors To Freeze Property Taxes Takes Effect Maine Public

Tax Maps And Valuation Listings Maine Revenue Services

York Property Tax Rate Falls As Town S Valuation Climbs 15 In One Year Maine In The Fall Property Property Tax